Are Car Parts Replacements Covered by Insurance in 2025?

In 2025, car ownership comes with its fair share of uncertainties—especially when it comes to repairs and replacements. One question that lingers in the minds of many drivers is: Are car parts replacements covered by insurance? The answer isn’t a simple yes or no. It depends on your policy, the type of damage, and several other factors unique to your situation. With rising repair costs and evolving insurance options, understanding what’s covered can save you from unexpected expenses. Let’s dive into the details of car parts replacement coverage in 2025 and unpack everything you need to know.

Are Car Parts Replacements Covered by Insurance in 2025?>>>>>>>>>>>>>>>>>>>>>>

The Basics of Car Insurance in 2025

Car insurance in 2025 has adapted to modern vehicles, which are packed with advanced technology like sensors, cameras, and electric components. Standard policies still include liability, collision, and comprehensive coverage, but the scope of what they cover has shifted. Replacement parts—whether for a fender bender or a major breakdown—fall under specific conditions. If you’re wondering whether your insurance will foot the bill for a new bumper or engine repair, it’s time to look closely at your policy details.

What Documents Are Required to Apply for Second-Chance Auto Financing in 2025?>>>>>>>>>>>>>>>

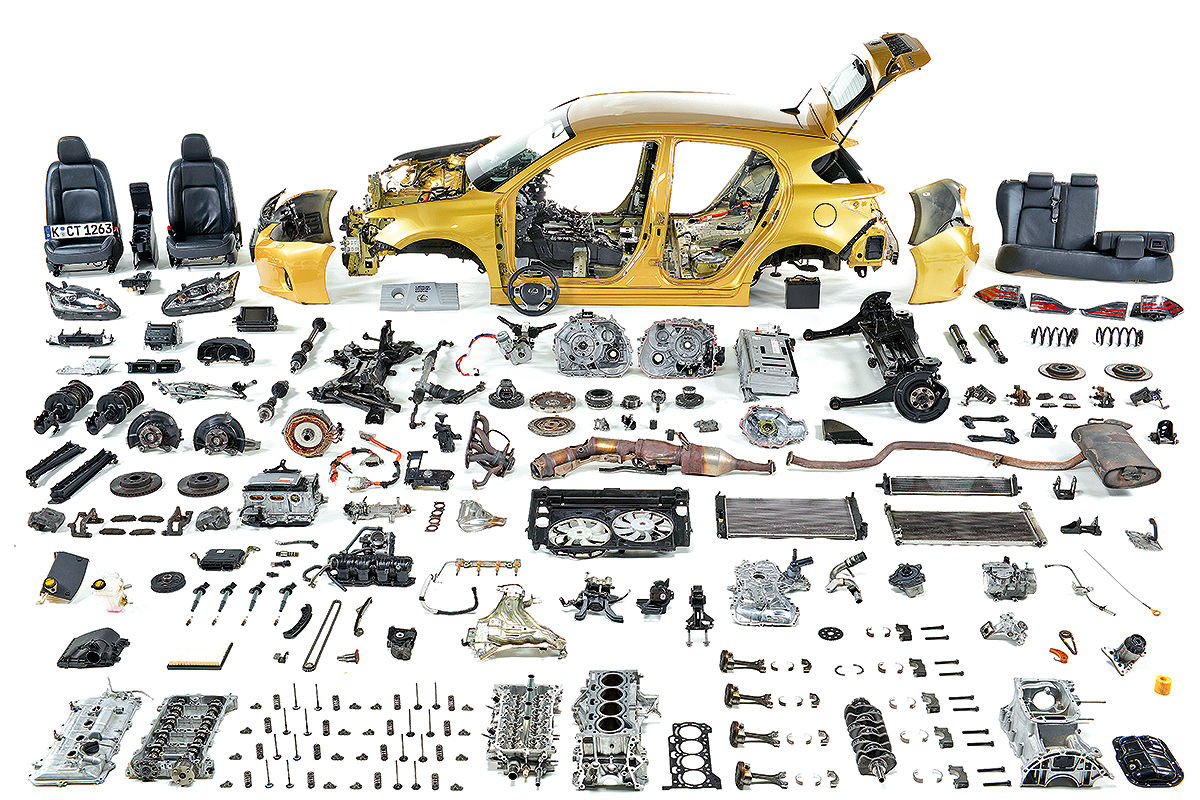

Why Car Parts Replacement Matters?

Car parts aren’t cheap, and in 2025, they’re more expensive than ever. Inflation, supply chain challenges, and the complexity of modern vehicles have driven up costs. A single headlight replacement can cost hundreds of dollars, while an engine overhaul might set you back thousands. Insurance can be a lifeline, but only if you know how it applies to parts replacement. Without the right coverage, you could be left paying out of pocket for repairs you assumed were included.

Where Can Single Moms Find No-Credit-Check Housing Loans in 2025?>>>>>>>>>

How Insurance Handles Replacement Parts?

Most insurance policies in 2025 cover replacement parts under collision or comprehensive coverage—but there’s a catch. Collision coverage kicks in if your car is damaged in an accident, while comprehensive coverage handles non-collision events like theft, vandalism, or natural disasters. However, policies often specify whether they’ll pay for original equipment manufacturer (OEM) parts or cheaper aftermarket alternatives. This distinction can affect both your repair quality and your wallet.

How Do I Compare Prices for Cheap Used Cars Online in 2025?>>>>>>>>>>

5 Things to Know About Car Parts Replacement Insurance

Understanding how insurance handles parts replacement is key to avoiding surprises. Here are five essential points every driver should know in 2025:

- Coverage Depends on Your Policy Type – Basic liability insurance won’t cover your car’s parts replacement. You’ll need collision or comprehensive coverage for that.

- OEM vs. Aftermarket Parts – Some policies only pay for aftermarket parts, which are less expensive but may not match your car’s original quality.

- Depreciation Applies – Insurance payouts often factor in depreciation, meaning you might not get the full cost of a new part.

- Add-Ons Expand Coverage – Optional riders like zero-depreciation or spare parts coverage can ensure better protection for replacements.

- Mechanical Breakdowns Aren’t Included – Standard policies don’t cover wear-and-tear repairs—consider mechanical breakdown insurance for that.

These points highlight why reviewing your policy annually is a smart move in 2025.

Are There Affordable Off-Road SUVs That Don’t Compromise Quality in 2025?>>>>>>>>>>>>>

Does Insurance Cover All Parts?

Not all car parts are treated equally by insurance companies. In 2025, coverage typically applies to parts damaged in covered events—like accidents or storms—but excludes routine maintenance. For example, if your brakes wear out from normal use, you’re on your own. But if a tree falls on your hood during a storm, comprehensive coverage should step in. Knowing which parts qualify can help you plan ahead.

7 Common Car Parts Covered by Insurance in 2025

Certain car parts are more likely to be covered under standard policies. Here’s a look at seven commonly included components in 2025:

- Bumpers – Frequently damaged in collisions, bumpers are typically covered under collision insurance.

- Doors and Panels – Side impacts or vandalism repairs often fall under comprehensive or collision coverage.

- Windshields – Cracked or shattered glass is usually covered under comprehensive plans.

- Headlights and Taillights – Damage from accidents or debris often qualifies for replacement.

- Mirrors – Side mirrors damaged in a crash are generally included in collision claims.

- Hoods – Dents or structural damage from covered events are eligible for replacement.

- Fenders – These are often repaired or replaced after minor accidents.

While these parts are commonly covered, always confirm with your insurer to avoid assumptions.

The Role of Deductibles in Replacement Costs

Deductibles play a big role in 2025 when it comes to parts replacement. If your deductible is $500 and a new fender costs $700, you’ll pay the first $500, and insurance covers the rest. Choosing a higher deductible can lower your premium but increases your out-of-pocket costs during claims. Balancing this trade-off is crucial for managing repair expenses.

10 Tips for Understanding Car Insurance Coverage

Navigating insurance in 2025 can feel overwhelming, but these ten tips will help you master your coverage:

- Read Your Policy Carefully – Look for specifics on parts replacement and exclusions.

- Ask About OEM Coverage – Clarify if your insurer uses OEM or aftermarket parts.

- Review Annually – Update your policy as your car ages or your needs change.

- Understand Deductibles – Know how much you’ll pay before coverage kicks in.

- Explore Add-Ons – Consider extras like zero-depreciation for full replacement value.

- Document Damage – Take photos to support your claim for parts replacement.

- Compare Providers – Shop around for policies with better parts coverage.

- Know Your State Laws – Some states mandate disclosure of aftermarket parts use.

- Ask About Repairs – Confirm if you can choose your repair shop.

- Stay Proactive – Contact your insurer immediately after damage occurs.

These steps empower you to maximize your insurance benefits in 2025.

When Insurance Won’t Cover Parts Replacement?

There are times when insurance won’t help. In 2025, wear-and-tear repairs—like replacing a worn-out clutch—aren’t covered by standard policies. Similarly, if you only have liability insurance, damage to your own car’s parts is excluded. Modifications or aftermarket upgrades might also fall outside coverage unless you’ve added custom parts protection. Knowing these limits can prevent costly surprises.

6 Factors Affecting Car Parts Replacement Insurance Claims

Several factors influence whether your claim for parts replacement succeeds in 2025. Here are six to consider:

- Policy Type – Liability-only policies won’t cover your car’s parts.

- Cause of Damage – Covered events (accidents, theft) qualify; neglect doesn’t.

- Car Age – Older cars may face lower payouts due to depreciation.

- Part Type – OEM parts cost more and may not be fully covered.

- Deductible Amount – Higher deductibles mean more out-of-pocket costs.

- Claim History – Frequent claims could raise scrutiny or premiums.

These factors shape how much support you’ll get from your insurer.

Aftermarket Parts vs. OEM: What’s the Difference?

In 2025, the debate between OEM and aftermarket parts continues. OEM parts come from your car’s manufacturer, ensuring a perfect fit but at a higher cost. Aftermarket parts, made by third parties, are cheaper but vary in quality. Many insurers prefer aftermarket options to keep premiums low, but you can request OEM coverage for a higher rate. Your choice impacts both repair quality and claim payouts.

8 Myths About Car Insurance and Parts Replacement Debunked

Misconceptions about insurance can lead to confusion. Let’s bust eight common myths in 2025:

- Myth: All Repairs Are Covered – Only damages from covered events qualify.

- Myth: Insurance Always Uses OEM Parts – Many policies default to aftermarket.

- Myth: Liability Covers My Car – It only covers damage to others.

- Myth: New Cars Don’t Need Extra Coverage – Parts can still be costly.

- Myth: Wear-and-Tear Is Included – Standard policies exclude it.

- Myth: Mods Are Automatically Covered – You need custom parts coverage.

- Myth: Claims Don’t Affect Premiums – Frequent claims can raise rates.

- Myth: All Insurers Are the Same – Coverage for parts varies widely.

Clearing up these myths helps you approach insurance with confidence.

How to File a Claim for Parts Replacement?

Filing a claim in 2025 is straightforward if you’re prepared. Start by reporting the damage to your insurer with photos and details. Specify the parts affected and request an adjuster’s visit. Be clear about wanting OEM parts if that’s your preference. Once approved, choose a repair shop and keep receipts. Quick action ensures faster resolution.

The Future of Car Parts Coverage in 2025

As cars become more advanced, insurance is evolving. In 2025, expect more policies tailored to electric vehicles and high-tech components. Insurers might offer flexible add-ons for sensors or batteries, reflecting the changing landscape of car parts. Staying informed about these trends keeps you ahead of the curve.

Conclusion

In 2025, whether car parts replacements are covered by insurance hinges on your policy, the damage type, and your preparation. Collision and comprehensive coverage can protect you from hefty repair bills, but exclusions like wear-and-tear or inadequate coverage can leave gaps. By understanding your policy, exploring add-ons, and debunking myths, you can ensure your car—and your wallet—stay secure. Review your insurance today to drive with peace of mind tomorrow.

Comments

Post a Comment